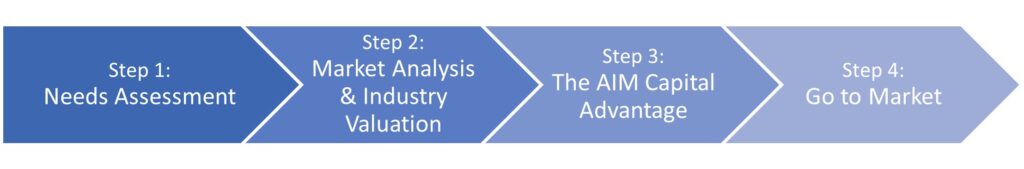

The AIM CAPITAL PROCESS

Our goal is to assist you understand and define your needs. Together, we will develop a work plan that will deliver a profitable acquisition, divestiture, merger, license, succession, or marketing program.

Whether you are buying, selling, or simply growing your business, success depends on having the right information, at the right time, to make the right decisions. Information is power. Information creates equilibrium and comfort between buyers and sellers that is necessary for a successful deal completion.

Using AIM Capital’s proven 4-step process, we take the time to get to know you and your business and customize our approach and services to meet your needs. Here is how we do it.

Step 1. Needs Assessment

We get to know you. We invest time with you to identify what you hope and expect to achieve and we assess your business’ readiness to act.

AIM Capital will conduct a complimentary review of your shareholder expectations, marketing material, and operational and financial records. This gives us the ability to understand your business, its needs, and to identify the various options available to you. Using our experience and expertise, we provide you with a preliminary assessment of your situation and our initial suggestions about the development and timing of your next step.

Step 2. Market Analysis & Industry Evaluation

We get to know your business. What is happening in the industry effects the value of a business and this information is essential to informing your decision making.

AIM Capital will prepare a review of your industry to get a current update of the landscape. We research relevant deal completions to provide you the data you need to make informed decisions about your acquisition, divestiture, merger or succession plan. The values for similar businesses bought or sold are researched and documented to help you understand the potential value of your business. A written work plan, deliverable schedule and fee payment agreement are negotiated with our clients.

Step 3. The AIM CAPITAL ADVANTAGE

We really get to know your business. The more you know about a business you are trying to buy or sell, the lower the risk; even if it is your own business!

Information is power and due diligence is everything.

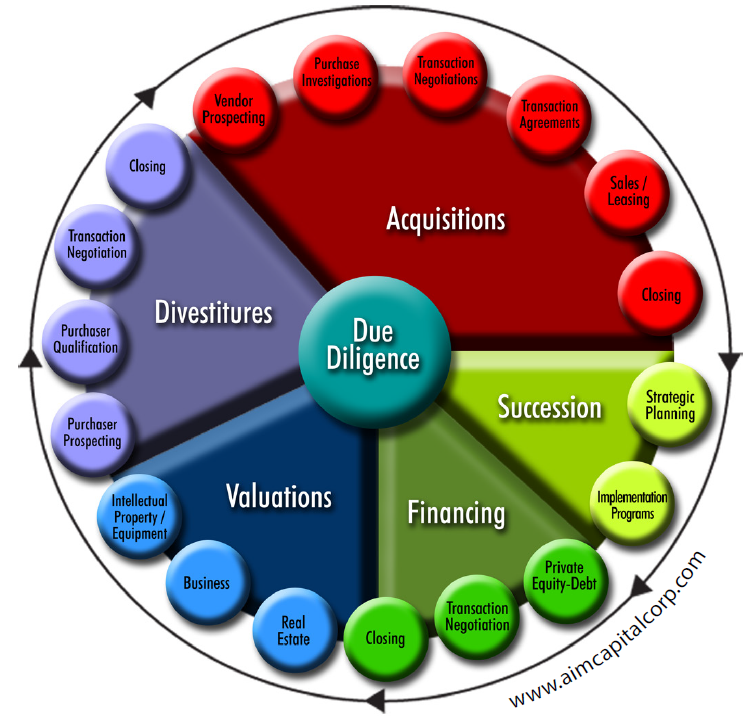

Utilizing the AIM CAPITAL ADVANTAGE, we prepare a comprehensive Confidential Information Memorandum (CIM) that provides an extensive due diligence package to inform decision making for both the buyer and the seller. A CIM completely surveys and analyzes the financials, tax, marketing, operational, legal, personnel, valuation, and contingent liability information you need to know about the business you are considering buying or selling. We include our expertise and knowledge of the industry to help critically review the business and assess its value.

Current and informed decision making is critical to our clients. AIM Capital prepares and actively updates the CIM from process commencement through to deal completion as new information becomes available. Comprehensively prepared CIMs provide two services. First, they provide a thorough overview of a company’s fiscal, social and operational health. This information is essential for marketing and upselling a business and how to grow it. Second, the elimination of uncertainty created by a well-prepared CIM can protect you from oversight in your due diligence and increase your net proceeds.

The AIM Capital Advantage is our diverse due diligence service offering.

Step 4. Go to Market

We act. We initiate an aggressive deal completion schedule. We identify, pre-qualify, determine anonymous interest by prospective buyers of your business. We discretely conduct purchase investigations of possible business acquisitions or licensing agreements.

AIM Capital takes the deal to market. Our process is designed to reduce risk for you. We update your required due diligence and document a time sensitive bidding plan to achieve your merger, acquisition, divestiture, succession, financing, and international marketing goals.

We typically organize an invitational auction or time limited request for proposals from prospects pre-approved by you. This occurs after interested parties have executed confidentiality, non-solicitation and non-competition agreements, financially qualified themselves, reviewed the CIM and met with your principals. The CIM and competitive bid process help AIM Capital achieve the best stakeholder outcomes.

We draft and include proven Offers of Sale or Offers of Purchase for our clients.